November 2025

Cracking the Buy Box: What Apparel Brands Need to Know to Win in Global Marketplaces

Ester Bazzanella

If you’re an apparel retailer selling on major marketplaces like Amazon or Walmart, the buy box can make or break your success. It’s the gateway to visibility, trust, and conversion, especially in a category where customers rely on speed and convenience. But what exactly is the buy box, and how can you win it without tanking your margins?

Here’s what you need to know to position your clothing brand or retail operation for buy box marketplace domination, not just on Amazon, but across global marketplaces.

What is the buy box?

The buy box, or the “featured offer”, is prime real estate on a marketplace product page.

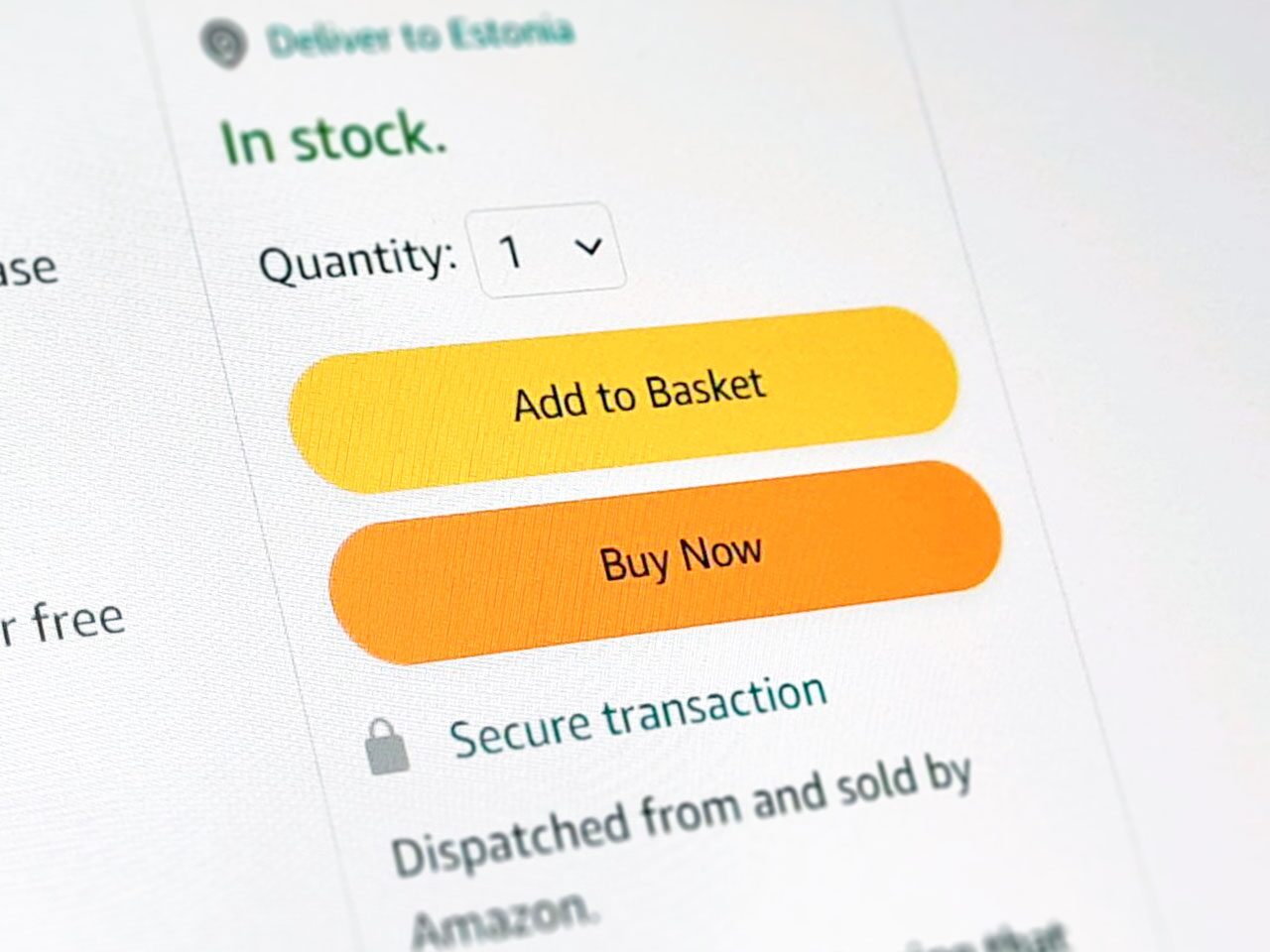

It’s the spot that lets shoppers buy fast, often with a single tap. On Amazon’s desktop site, it shows up as that clean white box on the right with the price, seller, shipping details, and those familiar yellow buttons. On mobile, it takes over the top of the screen, which means even more visibility.

Only one seller gets this placement at a time, even if dozens are offering the exact same item. Everyone else ends up behind a “See All Buying Options” link that most shoppers never open.

The buy box is similar to ranking number on Google in that most people will only click on the first link. And it matters because most marketplace sales flow through that box.

Depending on the platform, anywhere from half to over 80 percent of purchases happen directly through the buy box. On Amazon, the share is even higher. Shoppers trust the default offer and click “Add to Cart” without scrolling through other sellers. That behavior gets amplified on mobile, where one-click purchasing feels almost automatic. If you’re not in the marketplace buy box, your offer is basically out of sight. You’re competing for a small fraction of shoppers who take the time to check the other sellers list.

Related: E-Commerce vs. Marketplaces: A Fashion Brand’s Guide to Selling Online

How Marketplaces Decide Who Wins

Buy box eligibility and rotation is algorithmic. While every platform has its own secret sauce, here are the core levers you can influence:

1. Price Competitiveness

It’s not just about the lowest price. Most algorithms use the total landed price (item + shipping). You can sometimes win even with a higher price if other areas, like shipping speed or seller metrics, outperform.

That said, stay competitive. Platforms like Amazon will suppress the buy box entirely if all offers are priced too high or uncompetitive against external marketplaces. Dynamic repricing tools can help, but avoid a race to the bottom that kills your margins.

2. Fulfillment Speed and Method

Fast shipping wins. Period.

Sellers using Fulfillment by Amazon (FBA), Walmart Fulfillment Services (WFS), or Zalando’s ZFS often have the inside track. These services guarantee fast delivery and high service levels. If you’re fulfilling yourself, you need to meet, or beat, marketplace benchmarks for handling times, tracking, and delivery reliability. Hybrid fulfillment models (mix of marketplace and merchant-fulfilled) can help balance margin and service level across SKUs or peak seasons.

3. Seller Performance Metrics

Marketplace algorithms favor sellers that:

- Maintain high on-time delivery rates

- Minimize order defects and cancellations

- Respond to customer inquiries quickly

- Keep a strong feedback rating

In apparel, this means double-down on sizing accuracy, high-quality product photography, and fast returns management. The fewer surprises for customers, the fewer returns, and the better your metrics.

Related: How to Solve Sizing Uncertainty in Your Multi-Brand Store

4. Inventory Availability

Out-of-stock items or inconsistent availability will push you out of the rotation. Use inventory sync tools and real-time alerts to keep your stock levels healthy, especially across color and size variants.

Related: 10 Types of Fashion E-Commerce Tools to Boost Performance

Common Pitfalls to Avoid When Chasing the Buy Box

Winning the buy box feels like a win, but keeping it is the real challenge. Marketplace rankings shift often and apparel sellers feel those changes quickly because stock levels, size variants, and seasonal demand can impact eligibility. To stay competitive, watch out for a few mistakes that quietly hurt performance.

Over-Focusing on Price

Some retailers drop prices too far to gain visibility. This can spark margin-killing price wars or trigger buy box suppression when the item appears cheaper elsewhere. A smarter approach is staying competitive without racing to the bottom and watching for marketplace pricing alerts.

Weak Fulfillment Standards

Algorithms reward fast, reliable shipping because it matches shopper expectations. If competitors use marketplace fulfillment programs and you do not, you may fall behind. Strong fulfillment usually pays off with higher buy box eligibility and happier customers.

Inventory and Variant Issues

Stockouts, inaccurate size and color listings, and cancellations damage your metrics quickly. Apparel listings multiply that risk. Keep inventory synced and pause unavailable options to protect your seller health.

Declining Seller Metrics

High return rates, negative reviews, slow responses, or policy violations can take you out of contention even if your price is strong. Regularly reviewing your account health and collecting positive feedback builds marketplace trust.

A “Set-It-and-Forget-It” Mindset

The buy box is never static. Competition, policy changes, and even time of day can shift your status. Monitoring your win rate and setting alerts helps you respond before sales drop.

Avoiding these pitfalls keeps your buy box strategy resilient and protects the visibility you work hard to earn.

Evolving Trends Shaping the Buy Box

Marketplaces are constantly refining how they pick a featured offer and fashion sellers feel those changes more than most. Here are the shifts worth watching.

One major change is the rise of multiple buy boxes in some regions. In Europe, Amazon now shows a second featured offer when another seller has a meaningful difference in price or delivery speed. This gives shoppers more choice and gives sellers visibility even when they are not the lowest price or fastest shipper. Apparel sellers benefit when they have niche sizes or variants that might ship slower but offer better value. Regulators in the UK are evaluating similar models, so this could spread to other markets.

Shipping speed is also becoming a heavier factor. Marketplaces increasingly push offers that deliver faster, even at a slightly higher price. Programs like WFS on Walmart, or regional fulfillment networks, give sellers an advantage because algorithms use geo-location to show the offer that can arrive quickest for that specific shopper. This means winners can vary by region rather than nationwide. For clothing retailers, faster shipping also helps with quick size exchanges and happier buyers.

Customer experience metrics are getting more weight. Marketplaces are prioritizing seller responsiveness, smooth returns, and high satisfaction scores. Since apparel has naturally higher return rates, the way you handle those returns can influence buy box performance. Sellers with clean metrics and consistent service quality tend to rise above competitors even if their price is similar.

The buy box model is also spreading across more platforms. Retailers turning into marketplaces are adopting “featured offer” systems and even platforms like eBay and Mercado Libre have experimented with highlighting a top option when multiple sellers list the same item. Fashion retailers selling internationally need to understand how each platform handles price, shipping, and seller rating because the rules vary.

Another trend is category-specific logic. Fashion listings with multiple sizes and colors may reward sellers who offer a consistently strong experience across all variants. Buy box marketplaces also prefer sellers with verified authenticity in categories prone to counterfeits. Brand registry programs and authorized seller status are becoming essential for protecting your visibility.

Overall, buy box marketplace algorithms are moving toward more transparency and better customer outcomes. For apparel sellers, success comes from staying agile, tracking algorithm updates, and adjusting price or logistics as needed. The more data-driven your approach, the easier it becomes to stay visible and competitive across marketplaces.

Winning the Buy Box Isn’t Luck

It’s the result of smart pricing, reliable fulfillment, strong seller metrics, and a tight handle on inventory. For apparel brands, the stakes are even higher because customers expect fast shipping, accurate sizing, and a seamless experience from search to delivery. When you understand how the algorithms work and keep an eye on the trends shaping them, you put yourself in a position to compete with confidence.

Marketplaces will keep evolving, and the buy box will keep shifting. The brands that win are the ones that stay proactive. Track your performance, respond quickly to changes, and use data to guide every decision. Do that consistently, and the buy box stops feeling like a mystery. It becomes a predictable advantage that boosts visibility, trust, and long-term growth across every marketplace you sell on.

If you’re looking for more tips to boost your e-commerce sales, make sure to check out our introduction to fashion e-commerce marketing.